Unleash the power of risk-intelligent solutions with Rochdale! It’s not just about software or services, or ERM vs GRC, or even about risk.

It’s about transforming your financial institution into a future-ready powerhouse. Make decisions that resonate, prepare for uncertainty with confidence, and stay at the forefront of relevance!

We understand the chaos and the speed of change: shifting member needs, a surge in vendor reliance, a whirlwind of regulatory updates, increasing uncertainty, and a world of ever-changing events. But with Rochdale, you can cut through the noise and build a robust strategy and risk program that stands the test of time.

We’re much more than a powerful, cutting-edge risk management platform; we serve as a trusted partner and consultant. We don’t just identify potential vulnerabilities; we uncover new opportunities and guide you to pivot and thrive in the face of change.

Ready to REIMAGINE RISK to enable better decision-making, ensure sustainability and build paths to success? Connect with us today and let’s reimagine your credit union’s future together!

Industry-Leading Tools & Expertise

Rochdale operates at the intersection of strategy, opportunity and risk, focused on long-term relevance and success. We serve financial institutions because we believe in their missions.

It’s not just what we do; it’s all we do.

Software

- Enterprise Risk Management (ERM)

- Operational Risk Management (ORM)

- Vendor Management (VM)

- Issues & Actions Manager (NOW LIVE!)

- Document Repository

Services

- Enterprise Risk Management (ERM)

- Vendor Risk Management (VM)

- Risk Appetite

- Strategy

- Governance

Education

- VLI – Hawaii

- ERM Certification School

- Governmental Affairs Conference (GAC)

- Compliance & Risk Council Conference

- CU Management School

- Custom Board & Management Training

- Speaker’s Bureau

See Risk as an Opportunity Rather Than a Roadblock

In today’s ever-evolving financial services landscape, risk management and compliance are naturally top-of-mind. But for Rochdale, it’s much more than simply being compliant or creating efficiencies—it’s about seeing what’s coming, assessing operational readiness, identifying new opportunities, solidifying a foundation on which to succeed and then optimizing. It’s about discovering and taking advantage of new opportunities and propelling financial institutions to long-term relevance!

At Rochdale, we aren’t afraid of risk. In fact, we welcome it! We know, when properly identified and leveraged, more of the right risk leads to tremendous opportunities. While everyone else is trying to eliminate or minimize risk, Rochdale helps clients seek out risk-return tradeoffs for organizational growth and exceptional performance.

– Tony Ferris, CEO

Risk management software infused with decades of industry knowledge

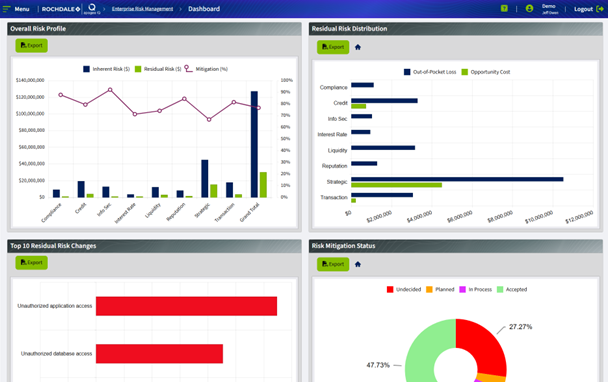

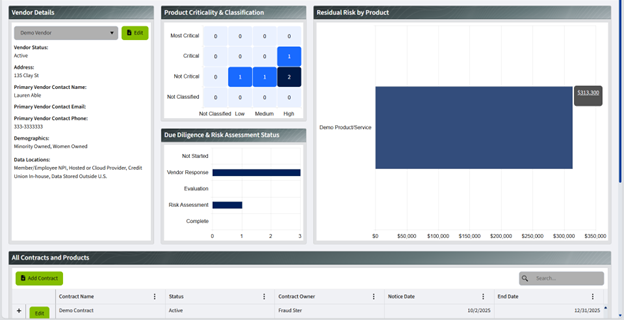

Our industry-leading risk management platform, apogee iQTM, helps you manage the risks specific to strategy, operations and third-party partners by integrating ERM processes and strategy with other critical functions like vendor management and regulatory compliance.

Manage, leverage and optimize risk using apogee iQ, the most intelligent and intuitive risk management platform on the market.

Our risk management software, apogee iQ, is infused with decades of industry knowledge, intuitive workflows and predictive modeling specific to the financial industry. Our team of risk experts and apogee iQ together deliver confidence and clarity for the toughest decisions facing your organization.

Industry Involvement

We are committed to the financial services industry. As your partner, we believe in investing in the development of people and teams. As such, we sponsor, host, support and collaborate on several key industry events each year, including:

- VLI – HAWAII

- ERM CERTIFICATION SCHOOL

- COMPLIANCE & RISK COUNCIL CONFERENCE

- CU MANAGEMENT SCHOOL

- GOVERNMENTAL AFFAIRS CONFERENCE (GAC)

- ASSOCIATION OF CREDIT UNION AUDIT AND RISK PROFESSIONALS (ACUARP)

- BOARD/MANAGEMENT TRAINING

- … AND MANY OTHER SPONSORSHIP & SPEAKING EVENTS